Why the Self-Help Group Model is Ready for Mobile

In June 2013, Code Innovation began working with partners at One Hen Inc. and Tearfund Ethiopia to "appify" Tearfund's Self-Help Group approach. To document Phase 1 of our project and share what we've learned with the ICT4D community, we're writing a two-part series about the Phase 1 of the project. We’re just beginning Phase 2, so there will be updates about this project phase through 2015.

In June 2013, Code Innovation began working with partners at One Hen Inc. and Tearfund Ethiopia to "appify" Tearfund's Self-Help Group approach. To document Phase 1 of our project and share what we've learned with the ICT4D community, we're writing a two-part series about the Phase 1 of the project. We’re just beginning Phase 2, so there will be updates about this project phase through 2015.

A Brief Background on the Self-Help Group Approach

Since 2002, Tearfund Ethiopia[1] has been working on developing and scaling an innovative Self-Help Groups (SHG) approach to help lift people out of poverty. Unlike many aid and development projects that struggle to show impact, the SHGs have demonstrated a cost-benefit ratio of 1:100 and an organic growth rate of 20-30% per year.[2] When we first learned about the project and saw these numbers, we knew that Tearfund's SHG model was special.

Tearfund adapted its SHG model from an SHG program run by an Indian organization called Myrada. After a few program visits to India to see how things worked, Tearfund Ethiopia's leadership began to implement the approach locally. In the 13 years since, Tearfund has supported local leaders in establishing and operating more than 12,000 SHGs around Ethiopia that have impacted more than one million people.

When we started to look more closely at how the SHGs effectively create long-term, holistic benefits, we learned that the impact of this approach lies in a participatory group model that is based on relationships. Facilitators help to catalyze the groups and guide the progress of their weekly meetings, but they are not leaders and do not exercise authority over group members. Instead, they lead members through a self-organized learning process that empowers members to take charge of their own development process.

How is the Self-Help Group Approach Different from Microfinance?

The original approach to microfinance, pioneered in the late 1970's by Muhammad Yunus at the Grameen Bank, relies on external capital to set up small business loans for groups of people who have little of what banks traditionally consider assets. The model relies on banking institutions to see the poor as potential customers and to create saving and loan products specifically for their context and needs.

Yunus’ model has enjoyed widespread adoption in the decades since he first developed it. In 2006, Yunus and the Grammen Bank received the Nobel Peace Prize and microfinance is now a pillar of banking services around the world. However, the microfinance model's centralized approach means that communities eager for microfinance must wait for a bank to reach out to them with appropriate products and services. Self-starting in this model is not an option.

SHGs are a similar to traditional microfinance groups in that they include approximately 15 to 20 people living in the same geographical community and with roughly the same economic status. However, their difference lies in the fact that SHGs target the poorest of the poor, many of whom don’t qualify for microfinance. Although both models are created by affinity, SHG members self-organize around a predominantly decentralized approach and do not need external institutions to begin their microsaving process. Together, SHG members establish their group’s bylaws, which are the operating principles that will guide the group as it begins to save and then loans its slowly-growing microcapital to members. The bylaws change and evolve with the needs and values of the particular SHG, forming an important structure for participatory processes of group decision-making.

In the SHG approach, groups slowly save enough for their first loan, collecting savings during weekly meetings and talking through agenda items that the group members identify themselves. Once members have discussed and agreed on the basics of group formation, saving and loans, the facilitator may lead the group through collaborative discussions around other topics of mutual interest to members, including issues like maternal and child health, HIV/AIDS and group members' vulnerability to hazards and disasters. Discussions are interspersed with activities and games that encourage the group members to brainstorm risk reduction, problem solve, and build trust in each other and themselves.

In addition to their savings pool, SHGs often set aside money for a social fund that they use as a form of emergency assistance for themselves and members in their communities. If an unexpected tragedy occurs, the social fund is disbursed to offer unconditional assistance to the person or family in need, helping to build the capacity of the community to meet the challenges they face. The social fund can also be used for community development projects that the SHG decides to undertake for the good of their community. Microfinance groups often have a social fund as well, but SHGs regularly act as powerful and self-reliant local development actors within their own communities.

Each SHG sets their own interest rate on loans, which is often a small fraction of the interest rates charged by local moneylenders in Ethiopia, estimated at around 60% in some communities. Like their bylaws, SHGs can also change their interest rates when they feel it's time. This allows them to be flexible and make loans that are well-aligned with the group and members’ interests, circumstances, and local context. Microfinance banks are usually not so flexible.

Another thing we find exemplary about SHGs is their capacity to self-organize into Cluster-Level Associations (CLAs) once there are eight or more mature SHGs in one community or area. CLAs include two members from each SHG who serve for two-year terms -- although the specifics of these logistics are self-determined by each CLA and, therefore, can vary. CLAs allow SHGs to democratically respond to and support each other through trainings, problem solving discussions, and conversations, with weaker groups benefiting from the experience and expertise of stronger groups. The CLAs’ functions reinforce the democratic processes in place at the SHG level. What's more, CLAs often seed new groups, so the SHG process effectively self-replicates without outside program support or assistance.

Once SHGs are so established that a network of CLAs exists, members form a Federation-Level Association (FLA) to host a general assembly of CLA representatives and guide other participatory decision-making processes with the aim to strengthen and support SHGs at scale. None of this would work if the groups themselves weren't making a substantial and lasting impact on the lives of their members. The SHGs' ability to self-organize into participatory, democratic FLA structures that advocate and advance their interests speaks to the powerful mechanisms at play within these groups. Some of these FLAs have even taken the steps to gain government recognition as formal associations and now use this status to further advocate for the needs of their members.

Lastly, it’s worth noting that some recent studies of micro-finance initiatives have concluded that, on their own, these initiatives are not sufficient to combat poverty. It’s our belief that the SHG model holds the promise of greater impact than any of the finance experiments so far undertaken by vulnerable or marginalized communities.

How Self-Help Groups Work to Benefit their Members and their Communities

The main purpose of SHGs is to empower impoverished community members to come together to lift themselves out of poverty. In addition to the microsavings element, relationships are key. Over the course of many meetings, the group members form strong bonds and become like family to each other. In addition to supporting one another through loans and micro-entrepreneurship, members also support one other in times of challenges and encourage each other in times of opportunity. Through group discussions and collaborative activities, members also learn about small business skills including market research, production, sales, bookkeeping, and so forth. By becoming successful micro-entrepreneurs, the members -- who are predominantly women -- lift themselves out of poverty while benefiting their communities. Women make up the majority of SHG members and their financial success has wide-reaching impacts on gender norms and roles, including women's participation in family and community decision-making.

Tearfund Ethiopia has also found that as they continue to meet, SHG members learn to speak up and more freely express their opinions and needs. As such, SHGs are often found to be an effective empowerment strategy for women and girls who otherwise would not be encouraged to express their thoughts and opinions or participate in powerful decisions that affect their opportunities and lives. SHGs have also been found to improve relationships between different religious communities because Muslims, Christians, and people of other faiths are routinely members of the same SHG.

The wealth created over time by members in their SHGs has a wide-reaching impact on their households and communities. Members also enjoy increased opportunities for leadership development and improved decision-making status and power within their households, as well as strong social and emotional bonds their SHG peers that create powerful incentives for mutual support and assistance.

Most SHGs members remain in their groups for over a decade and many express a life-long commitment to one another. There are regularly cases of SHG membership being inherited by family members when an SHG member dies, because belonging to an SHG is seen by the family and community as a highly-valued social and economic asset. Long-term relationships between group members also play a strong role in creating social resilience to shocks and disasters that may occur within the community. Even without shocks or disasters, strong SHG relationships encourage members to pursue their own empowerment and self-organized learning, helping them to become agents of change in their lives and communities.

Why We Decided to Take the Self-Help Group Approach Mobile

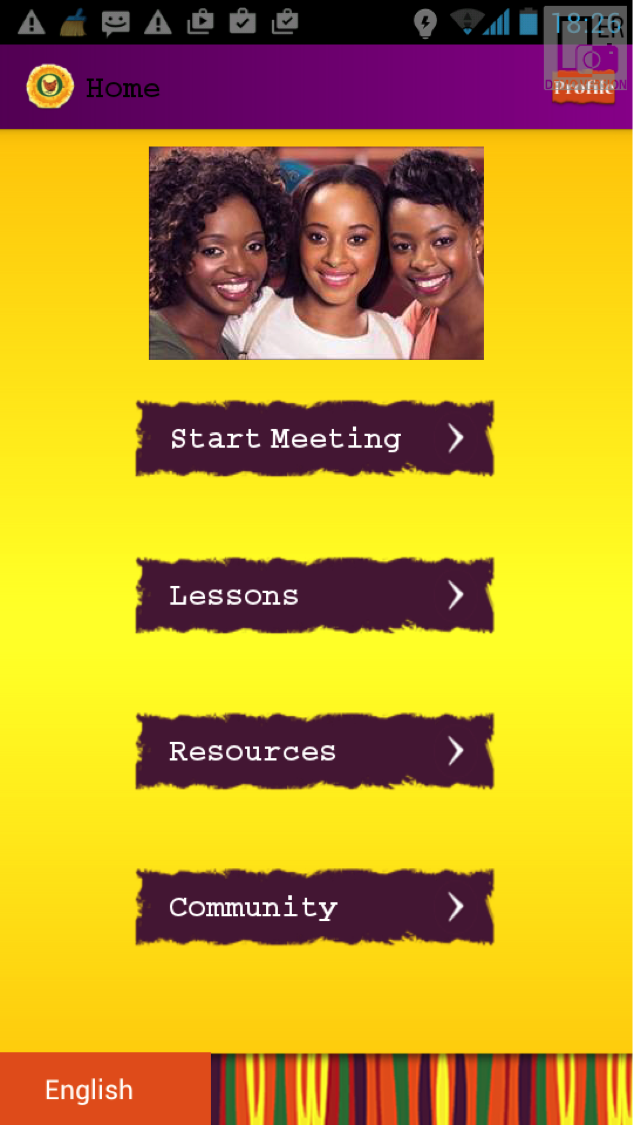

As mobile increasingly becomes the preferred technology platform and begins to connect hard-to-reach rural and poor communities, we are building mobile apps that extend the reach of proven high-impact aid and development programs.

The one factor limiting the rapid scale of SHGs is that, for their first few years, they require the weekly presence of a trained facilitator who understands the SHG process and the importance of collaborative, horizontal groups and a participatory self-organized group learning process. These facilitators require training, mentoring and supervision, as well as resources to adequately pay them and the NGO that supports them. Scaling in this way will take decades and huge sums of money.

Tearfund is scaling up its SHG approach in other countries, and we see mobile as a way to support this process and eventually to create SHGs that do not require direct contact with their organization. With mobile, SHGs can have the opportunity to scale globally and impact hundreds of millions of people. We hope to spread these resilient and transformative groups throughout the world and are hopeful that this will make a meaningful contribution to empowering women and their families’ lives.

Our next article will examine the SHG pilot that we ran with One Hen Inc. and Tearfund Ethiopia last year, looking at how we set up the project and what we learned.

*

Thanks for reading! For more information about our work with mobile education, ICT4D and the Self-Help Group app, email info@codeinnovation.com. You can subscribe to future updates from Code Innovation here.

*

[1] Tearfund actually works with a network of strong local partners who implement, support and scale the SHGs. However, to keep things simple, we’ve called the whole network “Tearfund” in our series.

[2] Cabot Venton, C et al (2013). "Partnerships for Change: a cost benefit analysis of Self Help Groups in Ethiopia." Tearfund, Teddington, UK